[ad_1]

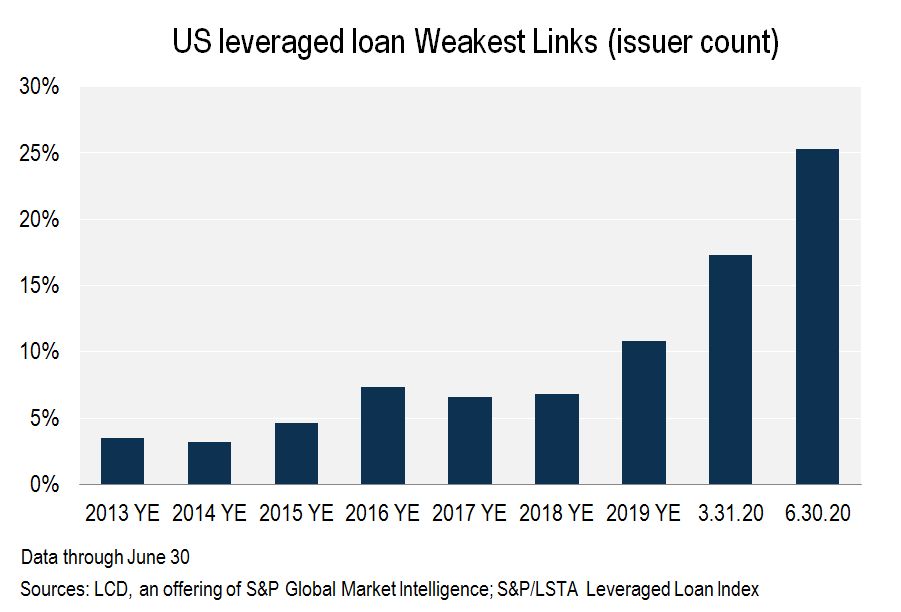

The COVID-19 pandemic has once again pushed the number and proportion of US leveraged loans “Weakest Links” to record highs.

At the end of June – this includes the first full quarterly figure since the start of the coronavirus pandemic – the number of weakest links of loans recorded by LCD rose to 329 issuers, from 227 in March and 145 in December 2019. As a result, the proportion of weakest links increased on Credit market to 25% at the end of June, from 17% at the end of March and from 11% at the end of 2019.

|

The weakest links in LCD are loans with a corporate credit rating of B- or lower and a negative outlook from S&P Global Ratings. The “Loans Weak Links” composite may change historically as LCD coverage expands the universe of loans it tracks for this analysis.

Register for our free webinar on distressed debt in the energy sector:

In the context of the growing number of the weakest links, as the coronavirus pandemic cripples businesses and devastates the U.S. economy, companies are increasingly drawing on their bank lines to secure liquidity. Of the 329 weakest links that are being followed by LCD, 72 are on LCDs Revolver drawdown tracker – A list and industry breakdown of companies that pulled their revolvers since early March as the impact of the coronavirus pandemic hit the U.S. economy.

In addition, the proportion of bad debts and restructurings in the weakest link analysis has more than doubled in the past three months, to 44 on June 30th, compared to 16 on March 31st. This is the highest level since this analysis started in 2013, compared to the previous high of 27 issuers in late 2019. The majority of these 44 borrowers were on the weakest link in credit prior to the outbreak of the COVID-19 pandemic. Some notable exceptions are Cirque Du Soleil Canada Inc., Men’sMen’s Wearhouse, Hertz Global Holdings Inc., and CEC Entertainment Inc. These borrowers weren’t part of the weakest link cohort at the end of 2019.

Both the downgrades and the deteriorating outlook contributed to the spike in the weakest links in credit in the second quarter of 2020. Of the 329 issuers on the list, 137 are new to the cohort, including 63 who were added due to a notch, downgrading to B- (with a negative outlook). Another 63 borrowers already had a B rating, but changed the outlook to negative between April and June.

|

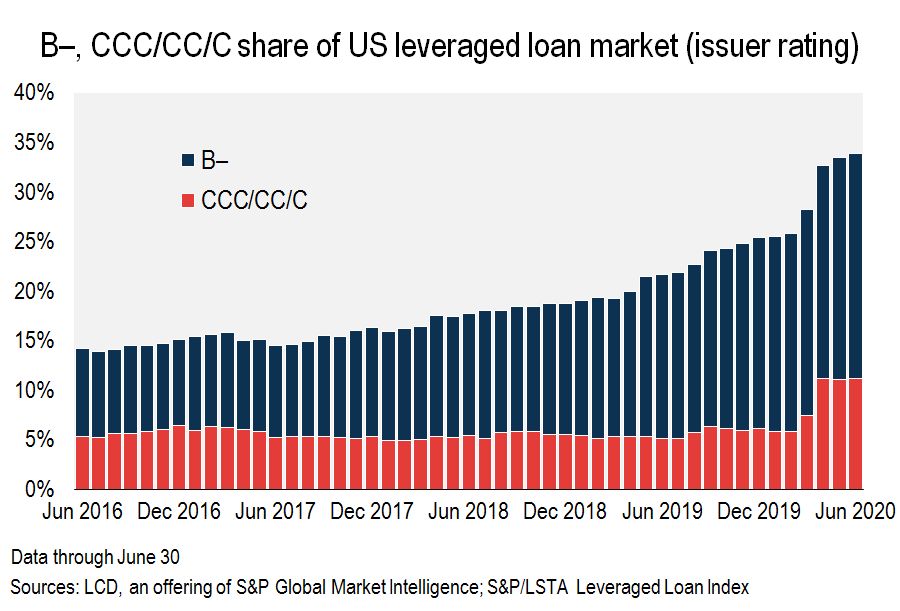

The pace of downgrades increased in the second quarter in the wake of the COVID-19 pandemic, so that around a third of all issuers in the S & P / LSTA Leveraged Loan Index remained with a rating of B- or lower (34% of the outstanding nominal amount). This is a record high, down from 28% at the end of March and 22% a year ago. Issuers falling in the C to CCC + range now make up 11% of the index, down from 7.5% three months ago and 5% a year ago.

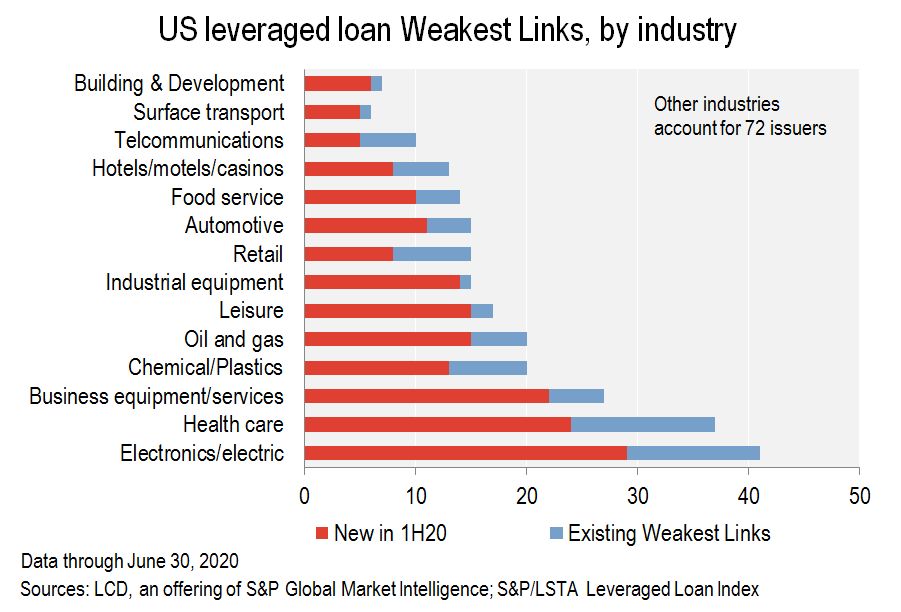

The impact of the COVID-19-related downgrades and deteriorating outlook spread to all sectors this year. Most of the new entrants and the total number of weakest links came from the electronics / electrical (LCDs surrogate for the technology sector), healthcare and office equipment / services sectors. These sectors are also the three largest industries in the overall credit market, making up 34% of the $ 1.2 trillion institutional credit market, based on the S&P / LSTA index. Their leading position among the weakest links is in line with their general presence in the credit market.

|

In contrast, the entertainment, recreational and industrial equipment sectors saw strong increases in the weakest links this year compared to their overall presence in the cohort. Fifteen entertainment and leisure borrowers joined in the first half of this year, bringing the total to 17 (only two were in the cohort in 2019). Likewise, 14 out of 15 industrial borrowers were new this year.

|

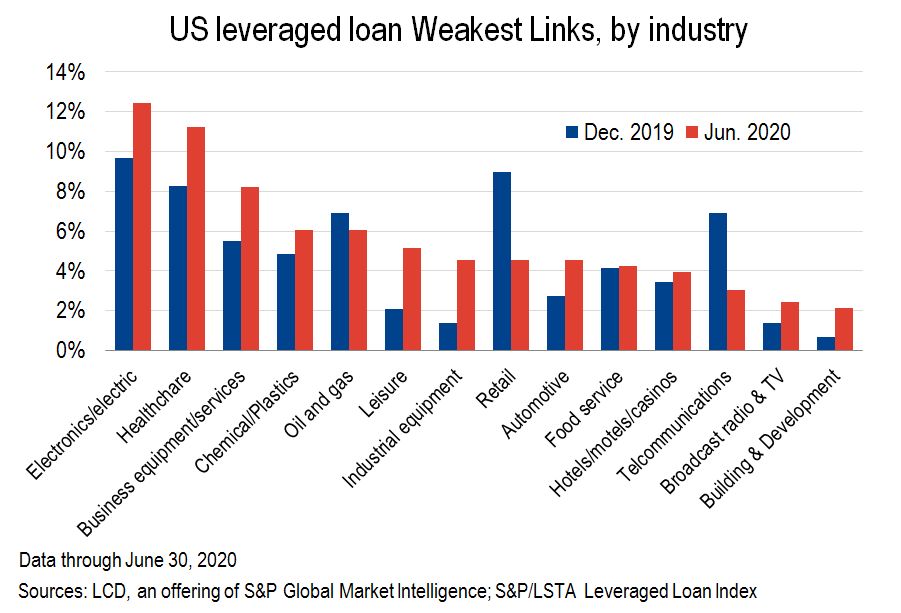

Looking at the data from a different perspective, the graph above shows each sector’s share of the total weakest links as of June 30th compared to the end of 2019, based on the number of issuers. While electronics / electronics took the top position both this year and in 2019, the second and third largest sectors shifted away from retail and telecommunications to healthcare and business equipment / services.

Retail, a sector that has dominated corporate credit defaults in recent years, saw a decline to 5%, representing its overall 9% share of the credit market. Most personal borrowers have been on investors’ emergency radar for some time. Eleven of the 15 companies in the sector on the current list joined before 2020. Additionally, of the 44 outages tracked in this analysis, six came from retail – the second highest number after oil and gas with seven emitters.

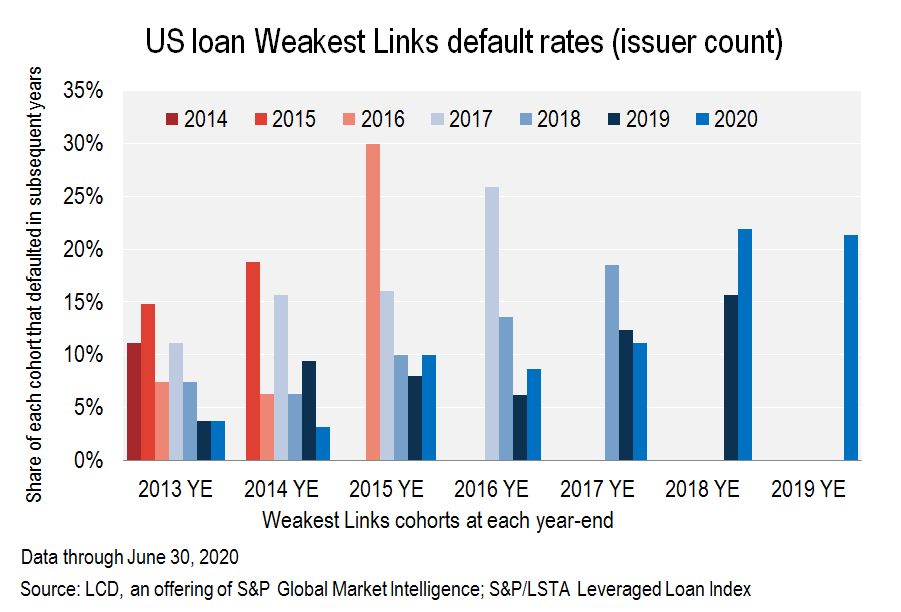

At the end of the second quarter, the default rate of US leveraged loans by number of issuers rose to 3.7% and ended on July 20 it had risen to 3.88%, a nearly 10-year high. As a result, a larger proportion of the former weakest links have failed. In fact, of the 145 names on the list at the end of 2019, 10 issuers, or 7%, defaulted in the first quarter of 2020. Of the 227 borrowers on the list on March 31, 24 defaulted between April and June, a rate of 11%.

|

In the past six months, a total of 31 borrowers from the weakest link cohort defaulted at year-end 2019, a rate of 21%. The sharp rise in the weakest links in 2020 implies an increased risk of default across the board.

Aside from default rates, another factor indicative of the health of the credit market is the ratio of downgrades to upgrades, especially at the lower end of the credit quality spectrum. By June, 35% of the credit market by face value had received a credit rating downgrade, the equivalent of $ 411 billion of the $ 1.2 trillion of credit rated at the end of 2019, the economic impact of the coronavirus pandemic. Until the first half of this year LCD tracked 114 covenant relief transactions, in the wake of the Great Financial Crisis, only six percent of the total for the first half of 2009.

This analysis was written by Marina Lukatsky, Senior Director of LCD Research.

Request an LCD demo to see more stories like this, as well as in-depth trend research:

[ad_2]