Oil fell more than 2 percent on Monday, weighed down by expectations of weaker global demand and US dollar strength ahead of potential big rate hikes, though supply concerns limited the decline.

Central banks around the world are certain to hike borrowing costs this week to tame high inflation, and there is some risk that the US Federal Reserve may rise by a percentage point.

For the latest headlines, follow our Google News channel online or via the app.

“The upcoming Fed meeting and the strong dollar are keeping prices under control,” said Tamas Varga of oil brokerage PVM.

Brent crude for November delivery fell $2.29, or 2.5 percent, to $89.06 a barrel by 1135 GMT. US West Texas Intermediate (WTI) for October fell $1.87, or 2.2 percent, to $83.24.

A British holiday for the funeral of Queen Elizabeth Activity was expected to be restricted on Monday.

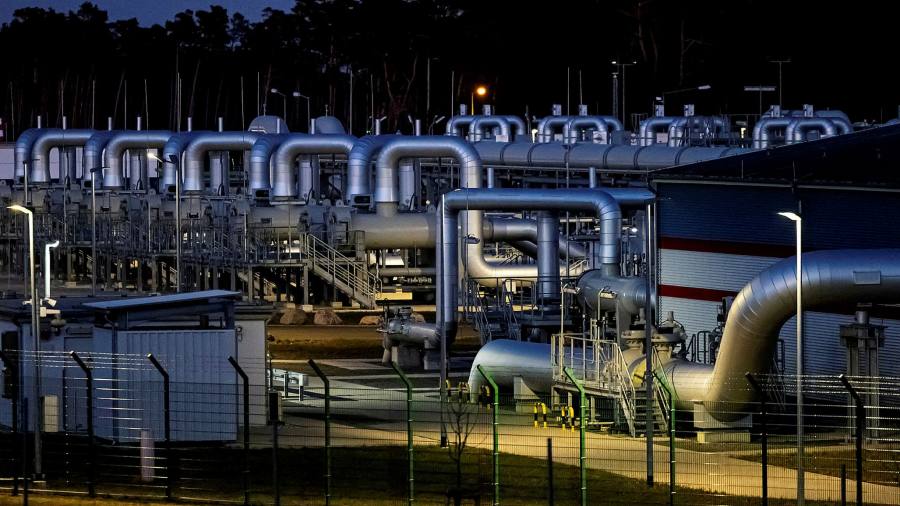

Oil also came under pressure from hopes of an easing of the European gas supply crisis. German buyers reserved capacity to purchase Russian gas via the decommissioned Nord Stream 1 pipeline, but this was later revised and no gas flowed.

Crude oil has risen sharply this year, with the Brent benchmark nearing a record high of $147 in March after Russia’s invasion of Ukraine heightened supply concerns. Concerns about weaker economic growth and weaker demand have pushed prices lower since then.

The US dollar remained near a two-decade high ahead of this week’s decisions by the Fed and other central banks. A stronger dollar makes dollar-denominated commodities more expensive for holders of other currencies and tends to weigh on oil and other risky assets.

The market has also been pressured by forecasts of weaker demand, such as the International Energy Agency’s prediction last week that there would be no demand growth in the fourth quarter.

Despite these demand fears, supply concerns kept the decline in check.

“The market is still hanging over the start of European sanctions against Russian oil. With supply halted in early December, the market is unlikely to see a quick response from US producers,” ANZ analysts said.

The easing of COVID-19 restrictions in China, which had dampened the demand outlook for the world’s second-largest energy consumer, could also provide some optimism, analysts said.

Continue reading:

EU plans summit on September 30 to approve energy contingency plans

Global Oil Demand Expected to Stop Growing in Q4 as Slowdown Takes Hold: IEA

British gas owner Centrica will voluntarily cap profits to cut energy bills